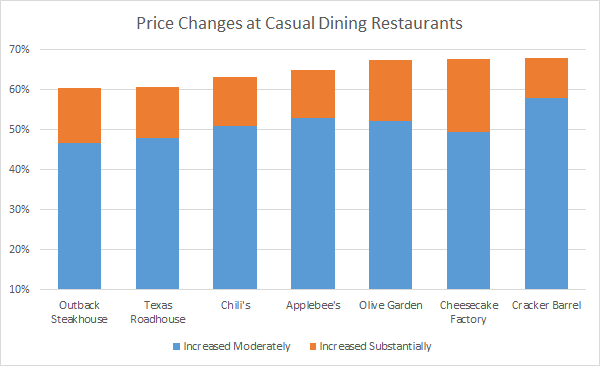

The landscape of restaurants was altered permanently because of the Covid-driven bankruptcies of popular chain eateries, family-owned restaurants, and mom-and-pop cafes. Nonetheless, restaurants that survived have reaped the rewards of a post-Covid surge, which has persisted despite months of increasing inflation, with Americans taking the price hikes in stride, seeing them as “moderate” rather than “substantial” (Figure 1). This could partly explain why recent results from QSR (quick service restaurants) and casual dining chains have been robust. But we see early evidence that the sustained rise in menu prices might finally begin to impact demand, with occam data revealing a recent decline in the number of anticipated household restaurant visits (Figure 2).

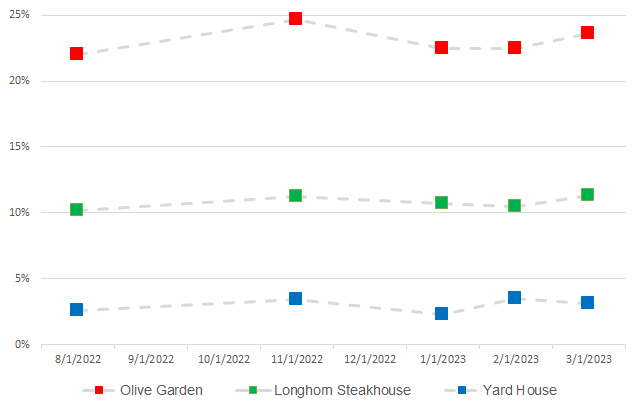

In Figure 3, we observe across all casual dining restaurants tracked by occam an overall intent to visit less frequently. Those who plan to visit less frequently exceed those who plan to visit more frequently by a substantial 8%. This differential has not materially hurt traffic trends so far. For example, in the past six months, some of Darden Restaurants’ most prominent brands have shown stability in traffic (Figure 4), which the company attributes to “underpricing inflation” to drive “better value for customers.” Nonetheless, given the downward trend in overall dining-out spending intent shown in Figure 2 and a similar negative intent observed for specific casual dining restaurants (Figure 3), it seems plausible that the stability in traffic might be short-lived.

Figure 5 illustrates intentions about the number of visits consumers plan to make to a variety of QSRs. occam data suggests that consumers are planning to cut back on QSR visits far more sharply than casual dining visits. Those who plan to visit QSRs less frequently exceed those who plan to visit more frequently by a surprising 21% (vs. 8% for casual dining). However, even within this set of QSRs, we see significant variation. For example, McDonald’s patrons anticipate more substantial cutbacks in visits than Chipotle patrons. Two possible reasons for this include: 1) Chipotle’s more affluent customers may be less sensitive to price increases (Figure 6); 2) McDonald’s has a relatively poor NPS score (Figure 7), and it stands to reason that when money is tight, consumers might first cut spending at QSRs with which they’re less satisfied.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Casual Dining

As restaurants respond to inflation with pricing shifts, consumers are taking notice

Dining Behavior

Diners took advantage of America's Grand Re-Opening but are starting to cut back on eating out

Casual Dining

On average net intent to visit casual dining restaurants is -8%

Darden

Darden's top brands remain steady

QSR

On average net intent to visit QSRs is -21%

QSR Demographics

Chipotle's more affluent customer base helps it better weather inflationary pressures

NPS

McDonald's, despite its market share, sits at the bottom of occam's NPS score sheet

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.